Product Design

PWC Digital

Future of Mortgage is a digital platform designed to help consumers better understand the mortgage qualification process and gain clarity around what they can afford. While leading design at PwC, I guided the team in creating an intuitive and educational experience that demystified a traditionally complex financial journey.

Future of Mortgage — Simplifying Mortgage Qualification Through Clear, User-Centered Design PricewaterhouseCoopers (PwC)

Challenge:

The mortgage application process is often confusing and overwhelming for first time buyers as well as experienced borrowers. Users are required to navigate income verification, credit requirements, budget constraints, regional rules, and varying lender criteria. Information is spread across multiple sources, and most consumers lack the guidance needed to understand what influences their eligibility.

PwC set out to build a platform that simplified this process from start to finish. The challenge was to present dense financial data in a way that felt approachable and actionable, while still maintaining accuracy and compliance. We needed a design that could balance education, transparency, and guidance without intimidating users or overcomplicating the experience.

Strategy and Design Approach:

The strategy centered on turning a complex qualification process into a guided, intuitive journey. I worked with stakeholders, financial analysts, and engineering to map the end to end process, identifying where users struggled the most and where clarity would make the greatest impact.

We aligned on three core goals:

Help users understand the steps required to qualify.

Educate them on the factors that influence approval amounts.

Provide clear, personalized insights based on their financial profile.

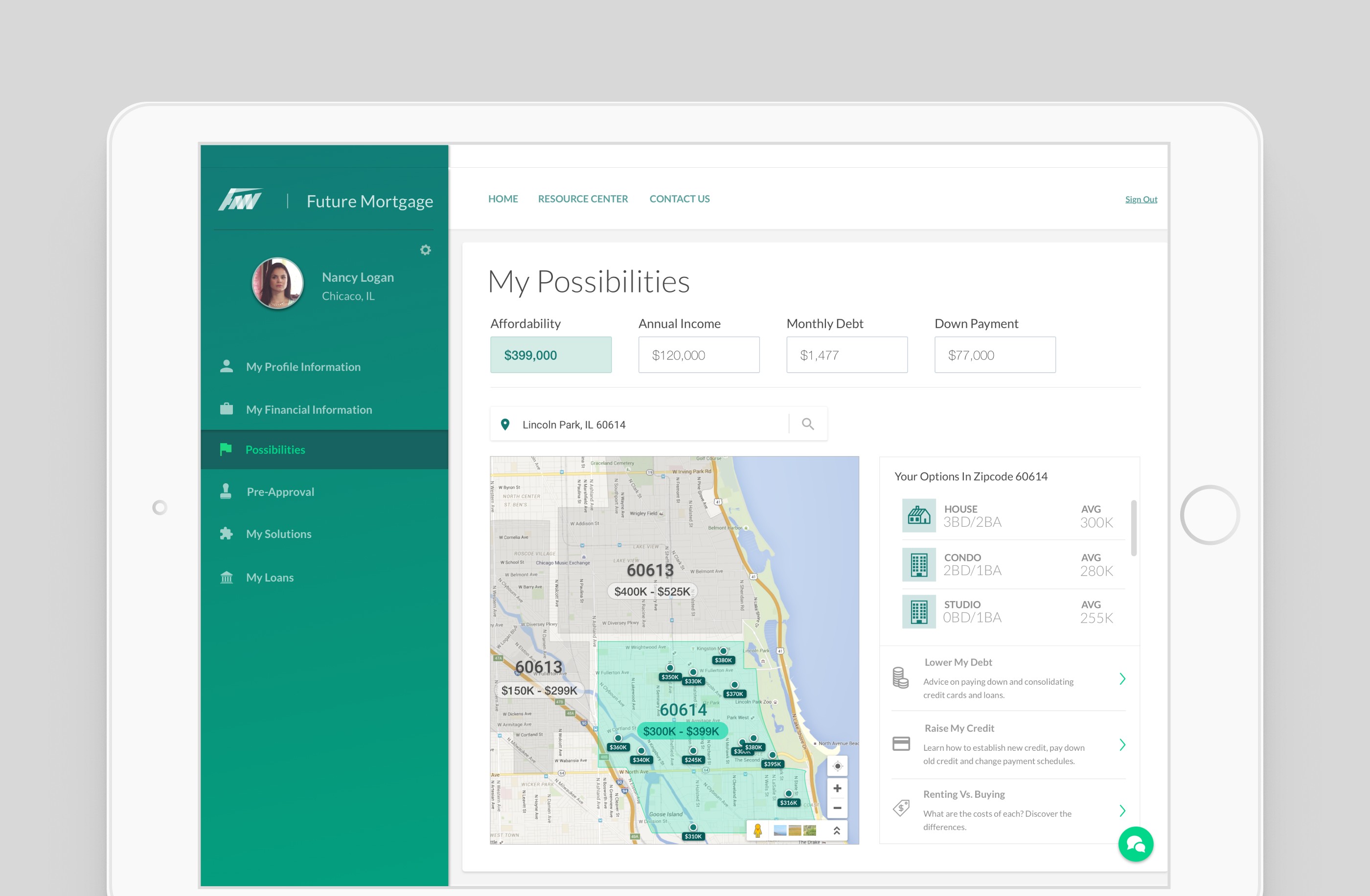

The design emphasized simplicity, visual clarity, and progressive disclosure. Instead of presenting all variables at once, we introduced information gradually, giving users digestible insights and real time feedback as they entered their details.

Design, Test and Development

Design:

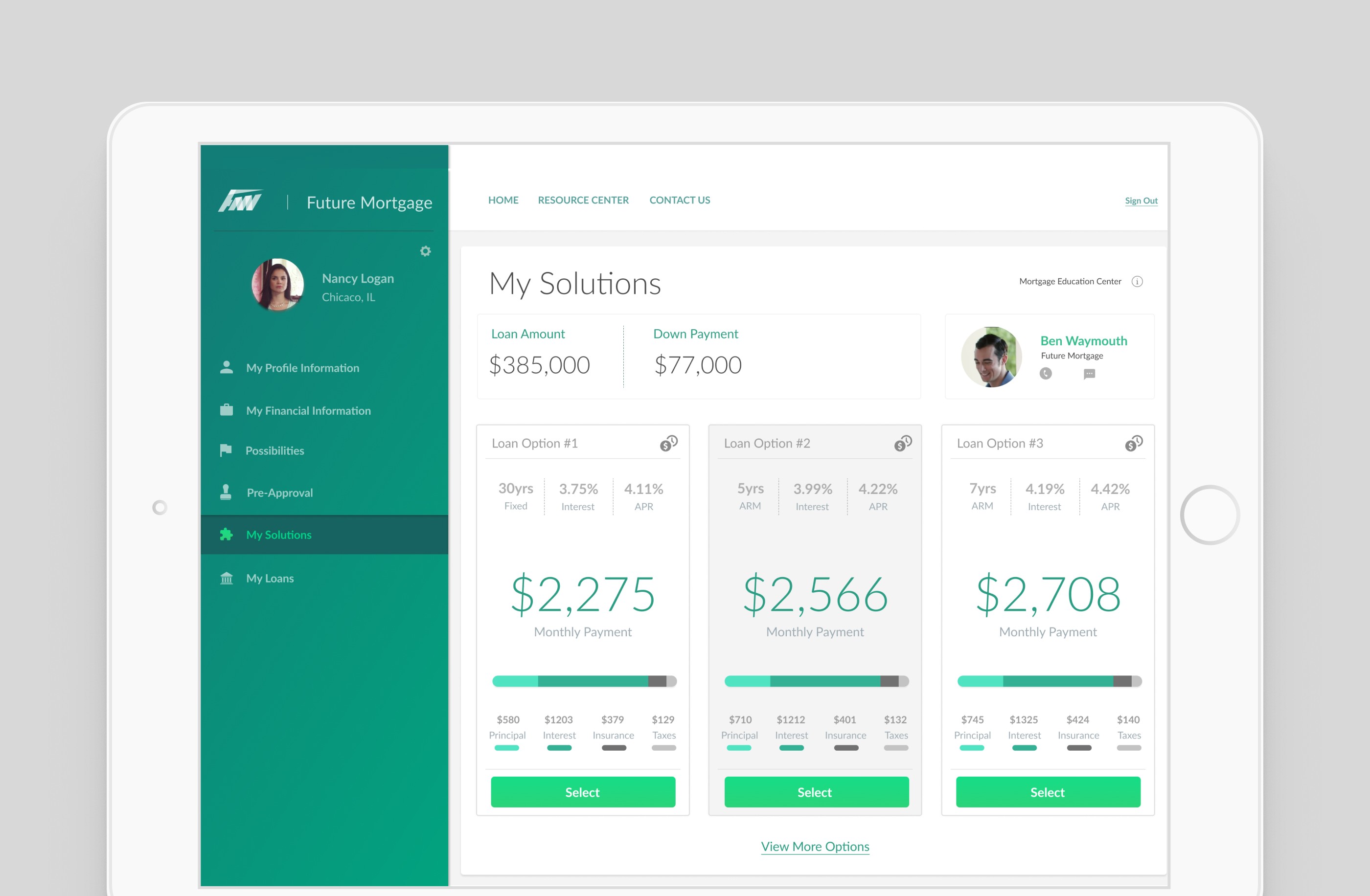

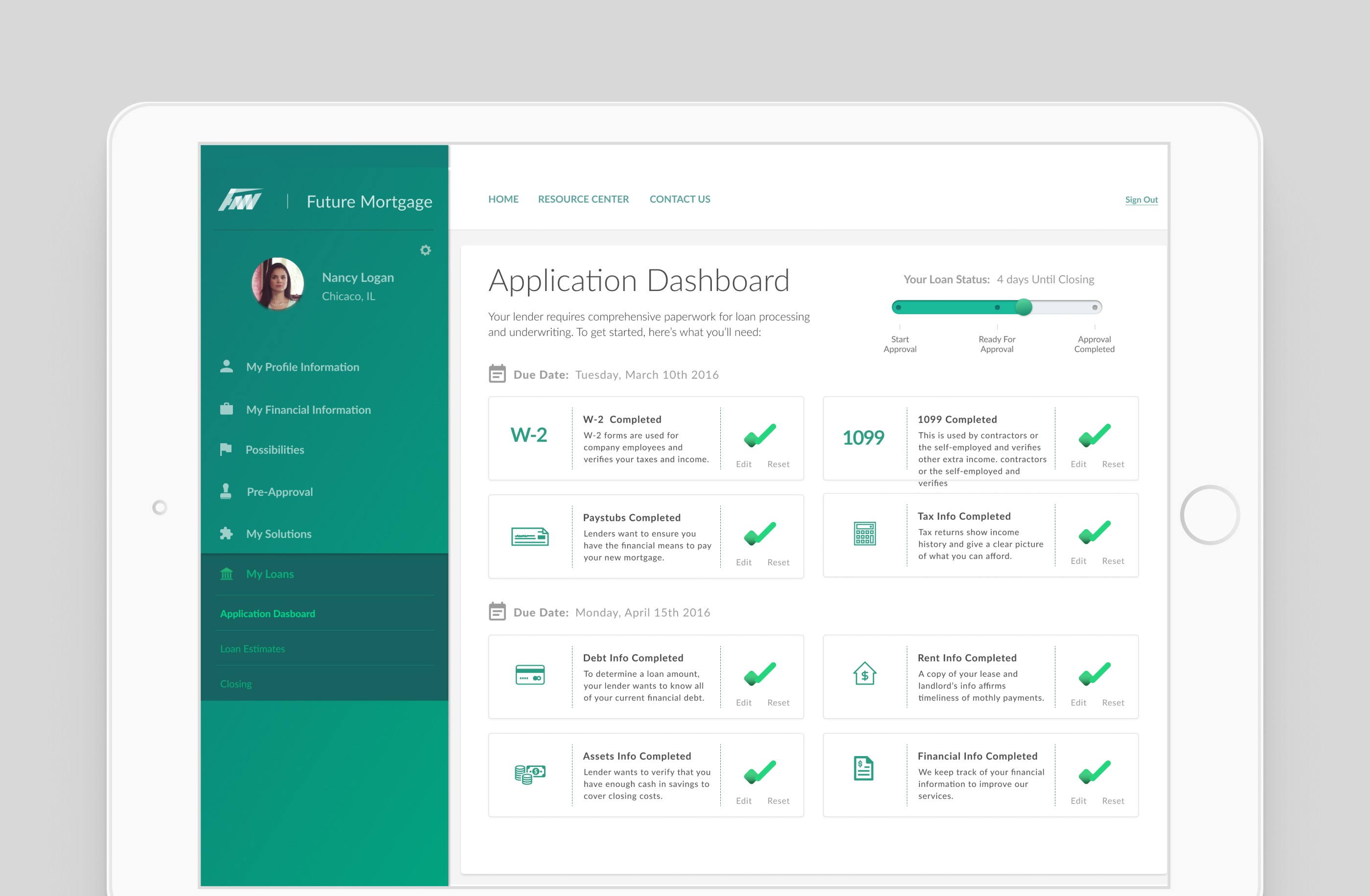

I led the creation of the platform’s foundational workflows, including onboarding, financial data entry, eligibility calculation, and educational moments woven throughout the experience. High fidelity designs showcased a modern, trustworthy interface, with visual indicators that helped users understand how variables such as income, credit, and geography affected their approval potential.

Interactive modules allowed users to experiment with “what if” scenarios, adjusting inputs to see how changes influenced their approval amounts. This made financial concepts more tangible and empowered users to make informed decisions.|

Test:

We tested prototypes with a diverse group of potential borrowers to validate clarity, comprehension, and emotional comfort. Testing revealed the need for clearer explanations around credit thresholds, simplified input steps, and more reassuring language during moments that could feel high stakes. Incorporating this feedback helped us build a platform that felt accessible rather than intimidating.

Development:

I collaborated closely with engineering to define data logic, visualization rules, input validations, and responsive behavior across devices. Our modular design system made it easier for engineering teams to scale the platform and adapt to evolving mortgage guidelines. We also accounted for compliance and security requirements, ensuring the platform met financial industry standards.

Future of Mortgage is a digital platform designed to help consumers better understand the mortgage qualification process and gain clarity around what they can afford. While leading design at PwC, I guided the team in creating an intuitive and educational experience that demystified a traditionally complex financial journey.

Impact:

Future of Mortgage successfully translated a complicated, multi variable financial process into a guided, user focused experience. The platform helped users gain confidence by understanding their qualification path, learning how key financial indicators influenced their approval status, and seeing clear, personalized metrics that supported informed decision making.

The product strengthened PwC’s ability to serve both lenders and consumers, demonstrating how thoughtful design and strategic collaboration can simplify one of the most important financial decisions in a person’s life.